UNO Digital Bank has partnered with Singlife to provide accessibility on financial protection.

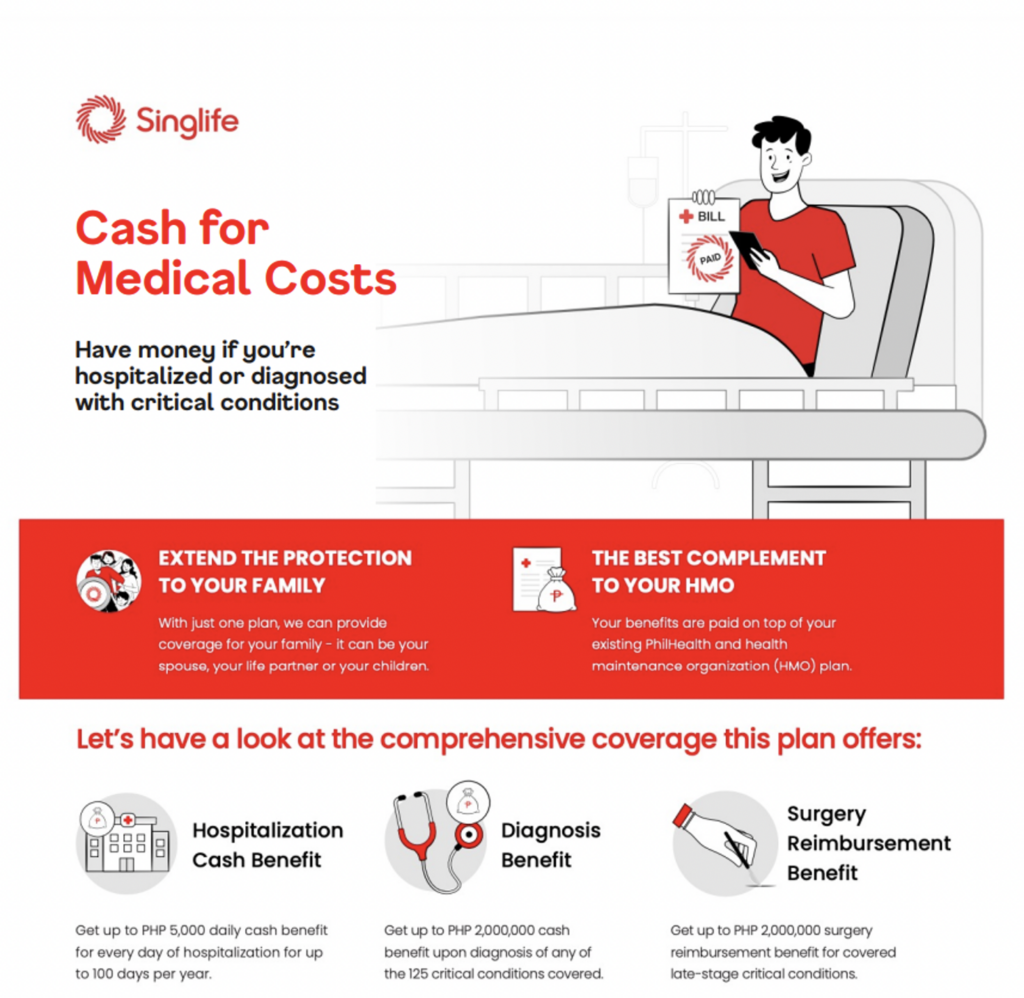

This product provides financial coverage for hospitalization and 125 critical conditions, ensuring that individuals and families can access quality healthcare without financial strain.

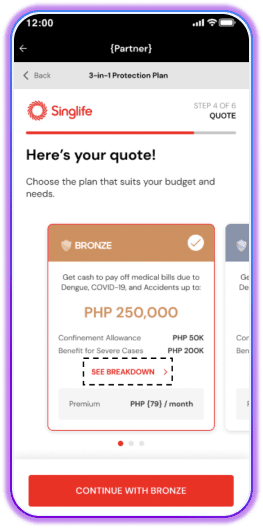

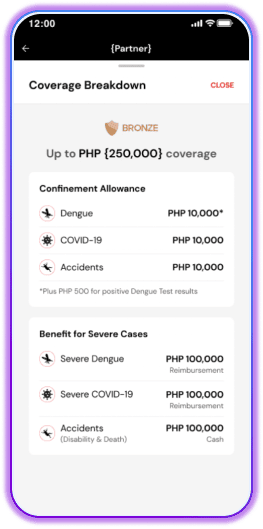

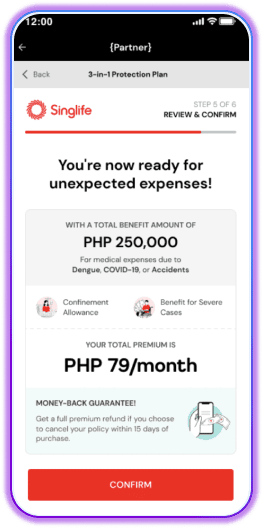

This product provides affordable financial coverage against dengue, COVID-19, and accidents for as low as ₱79/month. This gives meaningful coverage of up to ₱750,000 to you and your family at an affordable cost.

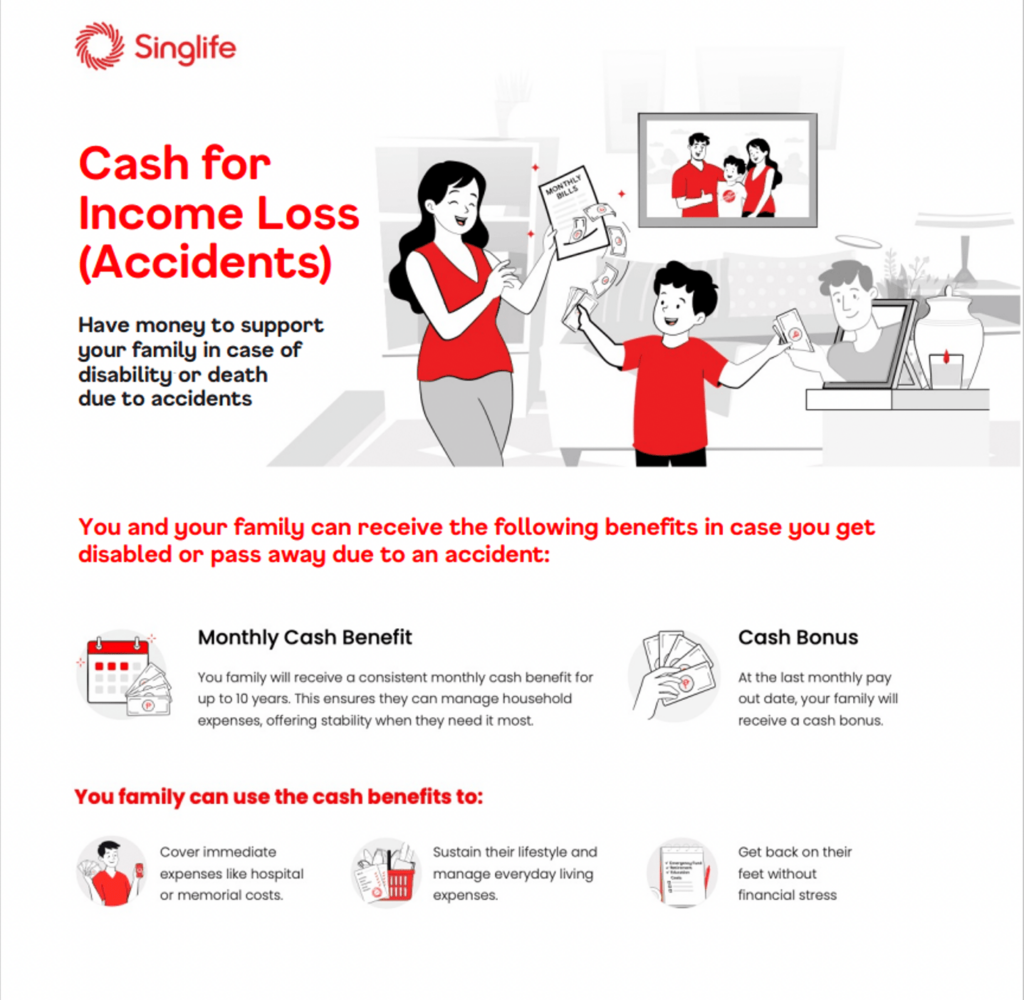

This product provides monthly cash support of up to 7 years in the event of income loss arising from death or disability due to accidents. This helps individuals and their loved ones maintain financial stability during challenging times.

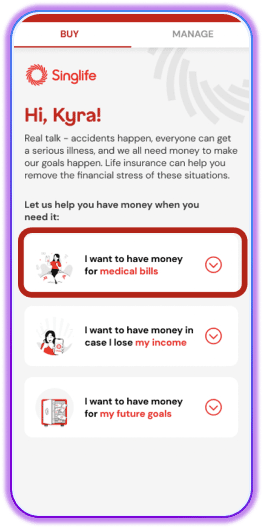

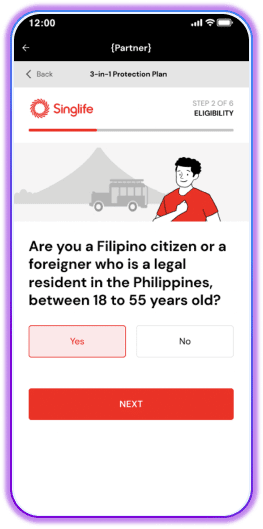

Get started by clicking on the Singlife banner in the UNO app and choose one of the options from the Singlife microsite

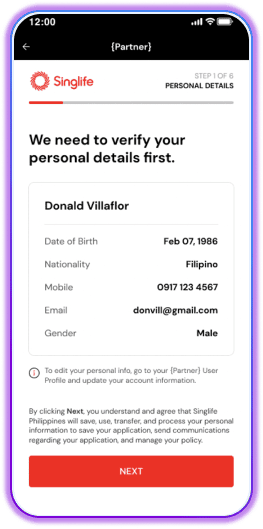

Verify your personal details

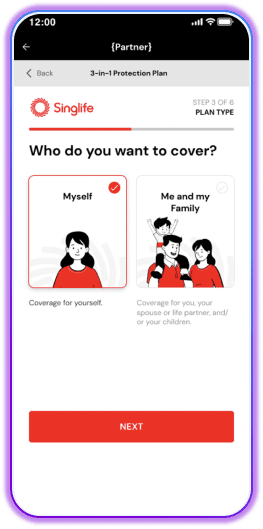

Select who you want to cover

Get a quote and select your preferred coverage

Review your details and tap “Confirm”

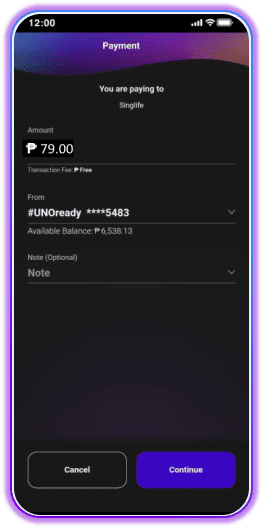

Proceed with payment and continue

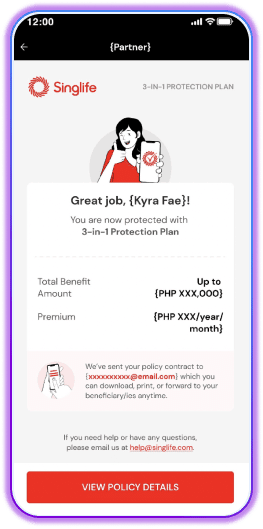

You will receive a confirmation page of the successful payment of your chosen policy

UNObank Inc. is regulated by the Bangko Sentral ng Pilipinas (BSP).

Deposits are insured by PDIC up to P500,000 per depositor.

Business Hours: 6am to 10pm, 7 days a week

UNObank, Inc. is regulated by the Bangko Sentral ng Pilipinas (BSP).

Business Hours: Monday to Friday, 8 AM to 5 PM