Frequently Asked Questions

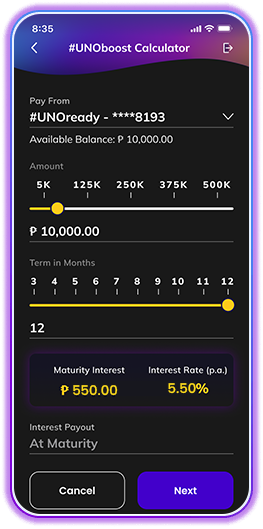

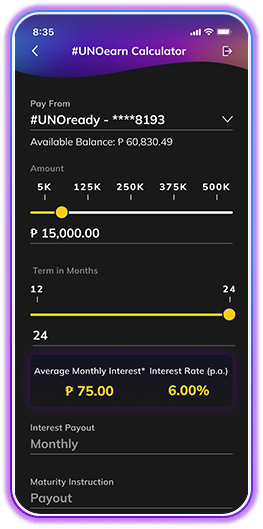

What is #UNOboost?

Grow your funds faster and securely with the high-rate #UNOboost Time Deposit account. Earn guaranteed interest while enjoying the flexibility to choose a term of 3, 4, 5, 6, 7, 8, 9, 10, 11, or 12 months.

What are the interest rates offered by #UNOboost?

Take advantage of interest rates as high as 5.50%, depending on your chosen term:

- 5.50% for a 12-month term.

- 5.00% for terms of 6, 7, 8, 9, 10, or 11 months.

- 4.50% for terms of 3, 4, or 5 months.

Interest earnings from this account are subject to government taxes and may change without prior notice.

Note: Interest earned is subject to a 20% withholding tax.

How do I open an #UNOboost account?

You can open an #UNOboost account instantly through the UNO Digital Bank mobile application by following these simple steps:

1. Tap on the “Accounts” icon (lower left) on the dashboard.

2. From the Accounts screen, tap on the “Add Accounts” icon (lower right).

3. Choose #UNOboost by tapping the “Open an Account” button.

4. Enter your investment amount, select your desired investment period, and you’re done!

Your UNO Time Deposit account will be funded from your #UNOready Account, so ensure it has sufficient balance.

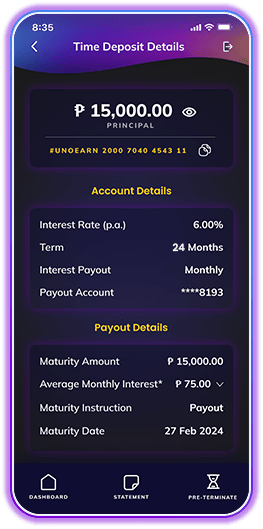

How can I get a copy of my Time Deposit Certificate?

Getting a copy of your Time Deposit Certificate via the UNO Digital Bank app is easy and can be done anytime, anywhere! Simply follow these steps:

1. Tap “Accounts” on the lower left of the dashboard.

2. Select the Time Deposit account for which you wish to obtain the Statement of Account.

3. Tap the TD Certificate icon at the bottom of the screen.

4. You can save the PDF Statement of Account to your device or send it through any available app on your device.