savings account

#UNOready

Make everything easy with our Savings Account. Send money, pay bills, and shop online while your money grows!

- Be ready to elevate your earnings with as much as 4.00% p.a. interest credited DAILY!

- Easy funding through InstaPay and PESOnet. Plus, you can Add Money online and over-the-counter at zero charges.

- Get free life insurance coverage worth PHP 50,000.00.

- Get a FREE virtual card when you deposit at least PHP 100.00.

Earn up to 4.00% interest

Be #UNOready! Elevate your savings with a 4.00% interest rate for deposits PHP 5,000.00 and up, and 3.50% for below PHP 5,000.00

No Fees

Zero transaction fees, Cash in for free online & over-the-counter in over 7,500 outlets nationwide*

*excluding PESONet charges from the sending bank

Life Insurance

Get free Life Insurance coverage worth PHP 50,000.00

Virtual Debit Card

Get a FREE UNO Virtual Debit Mastercard with a minimum deposit of PHP 100.00 only.

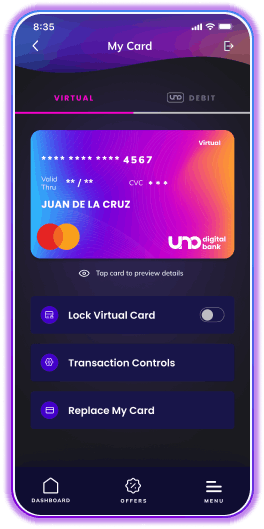

Virtual and Physical Card

Enjoy quick, convenient, and secure payments with the UNO Debit Mastercard virtual and physical cards!

Virtual Card

Get a FREE virtual UNO Debit Mastercard in 3 easy steps:

- Deposit at least PHP 100.00 to your #UNOready account

- Access “My Card”

- Activate your Virtual Card

COMING SOON

UNO Debit Mastercard

The first numberless card in the Philippines!

Your card details are stored inside the chip and are not visible on the card, making any lost or stolen card unusable.

Features

Enjoy secured banking, easy access to your funds, an elevated shopping experience, and exciting rewards with the UNO Debit Mastercard.

Safe & Secure

Access your UNO Virtual Debit Mastercard with a personal PIN and an OTP (One-Time Password).

Global Acceptance

Our UNO Debit Mastercard can be used virtually and physically at all Mastercard-accepting merchants worldwide.

Sustainable

Our cards are made up of 85.50% recycled plastic! They help reduce waste, energy, and pollution, which makes them great for the environment!

#UNOready is a HIGH-RATE savings account with tiered interest(1) rates. It comes with a Mastercard debit card to offer an easy and convenient way to make purchases and manage banking transactions. UNO Savings Account also comes with FREE life insurance with PHP 50,000.00 coverage.

It only takes a few minutes to open an account through the UNO Digital Bank mobile application. There is no initial deposit and no maintaining balance required to keep the account.

(1)Interest earnings from this account are subject to government taxes and may be changed without prior notice.

(2)Minimum deposit of PHP 100.00 is required to activate the FREE virtual card.

(3)Minimum average daily balance of PHP 10,000.00 is required to qualify. Age eligibility is between 18 and 65 years old subject to the acceptance criteria of the insurance provider.

A base interest rate of 3.50% gross per annum applies to accounts with available end of day balance below PHP 5,000.00 while a step-up interest rate of 4.00% gross per annum applies to accounts with an available end of day balance from PHP 5,000.00 to PHP 4,999,999.99. 1.00% gross per annum interest rate will be applied once the available end of day balance reaches PHP 5,000,000.00 or higher. Interest earned is credited to the account daily.

End of Day Balance | Gross Interest Rate | |

|---|---|---|

From | To | |

PHP 0.01 | PHP 4,999.99 | 3.50% |

PHP 5,000.00 | PHP 4,999,999.99 | 4.00% |

PHP 5,000,000.00 | Above PHP 5M | 1.00% |

Gross interest rate is applied to the total end of day balance.

You can compute for your interest earned for the day using the formula below:

Gross Interest Earned = Principal * Interest Rate * (1/number of days in a year).

For example, at the end of the day you have PHP 55.00 in your account. It means that gross interest earned is PHP 0.01 = 55*3.50%*(1/365).

The minimum interest that gets credited to your account is PHP 0.01.

Interest earnings from this account are subject to government taxes and may be changed without prior notice.

365 or 366 depending on the actual number of days in a year

– Individuals 18 Years of Age or Older

– Filipino Citizens

– Must have an active mobile number registered in the Philippines

– Must have a valid Philippine Mailing -Address

– Must have at least one (1) valid Philippine ID: (any ID listed below)

1. Passport

2. Driver’s License

3. UMID

4. SSS ID

5. PRC ID

6. PhilSys ID

7. PhilHealth ID

8. ePhilID*

*Note: For a straight through flow and real-time onboarding, we encourage you to use any of the IDs listed here other than your ePhilID. However, if you have no other valid ID aside from ePhilID, you can personally visit the UNObank office and our Customer Happiness Specialists will assist you with manual onboarding. Requirements are the following:

1. Ensure your mobile device and number to be registered with UNObank is with you or at hand at the time of visit.

2. Bring a clear printed copy of your ePhilID or your ePhilID (electronic)

UNObank office is open from Mondays to Fridays, 9am to 6pm.

| Online | Bank | Fee |

| Brankas | BPI | FREE |

| Union Bank |

| Over the Counter | Partner | Fee |

| Paynamics | 711 Cliqq Network Philippines | FREE |

| Bayad Center Network | ||

| Cebuana Pawnshop Network | ||

| Direct Agent 5 Network Philippines | ||

| ECpay Network Philippines | ||

| ETAP Network | ||

| Expresspay Network Philippines | ||

| M Lhuillier Pawnshop Network | ||

| Posible.net Network | ||

| SM Bills Payment Network | ||

| True Money Network |

You may Send Money to another UNO Digital Bank account or to another local bank account or e-wallet and also pay bills using the UNO Digital Bank mobile application FREE of charge.

Get Cash is available through the following channels subject to certain limits and charges:

| Over the Counter | Partner | Fee |

| Paynamics | Cebuana | PHP 50.00 |

| M Lhullier | ||

| Palawan | ||

| BDO and Rural Bank Partners | ||

| SM Cash Pick–up |

The full list of Get Cash channels is available in the UNO Digital Bank mobile application.

The free UNO Debit Mastercard enabled virtual debit card can be activated with a minimum deposit of PHP 100.00 to your #UNOready account. The virtual debit card may be used for online transactions.

Debit card limits can be managed in the UNO Digital Bank mobile application.

Below are the fees and charges associated with the use of the UNO Debit Mastercard Card:

| Transaction | Fee |

| Virtual Debit Card Issuance Fee | Free upon account activation |

| Virtual Debit Card Replacement Fee | PHP 50.00 |

| Physical Debit Card Replacement Fee | PHP 300.00 |

| Local Transactions | |

| Balance Inquiry | 2 FREE Transactions Per Month |

| PHP 2.00 Per Transaction Thereafter | |

| ATM Withdrawal | 2 FREE Transactions Per Month |

| PHP 15.00 Per Transaction Thereafter | |

| International Transactions | |

| International Transaction Service Fee | 2.50% of Transaction Amount |

| Balance Inquiry | As Levied by Acquiring Bank |

| ATM Withdrawal | As Levied by Acquiring Bank |

Terms and conditions apply.

UNO Digital Bank is a member of PDIC. Deposits are insured by PDIC up to PHP 500,000.00 per depositor.

For any concerns, you may call us at (+632) 8811 8866 during our business hours of 6am to 10pm – Mondays to Sundays, or send us a message via the UNO In-App Message.

One app for all!

Do everything in just a few taps! From saving, sending money, and shopping — all can be done with the UNO Digital Bank app. Elevate your banking experience and get started with us!

PDIC-insured

Deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) up to P500,000 per depositor

Member of PDIC

Deposits are insured by PDIC up to P500,000 per depositor.